About PurplePatch

Now, more than ever, credit providers want flexibility in contracts, to fill gaps in credit data information - and to not pay more than their competitors. And that's exactly why co-founders Nick Green and Nick Frazer set up PurplePatch: to ensure fair pricing and the best quality credit data for lenders' credit risk programs.

Backed by over 60 years of experience, PurplePatch creates transparency in both the quality of credit data available and the prices being charged to competitors.

This helps credit risk and procurement teams save thousands on the cost of credit data, ensuring you aren't paying as much as 1,500% more than competitors - whilst helping plug gaps in credit information by ensuring you choose a credit data provider that meets your exact needs.

- Save c.25%-40% on costs by working with PurplePatch

- We work independently, offering genuinely impartial and unbiased advice

- We offer our services at little or no cost

- We benchmark data price and quality of UK-based and International credit information

- No-one else offers this service

Credit data benchmarking in action

Here are some recent examples showing total and percentage of save...

- Banking : £2,000,000 saving over 5 years (28%)

- Banking : £5,100,000 saving over 3 years (40%)

- Banking : £2,800,000 saving over 3 years (26%)

- Finance Retail : £3,000,000 saving over 5 years (23%)

- Finance Motor : £450,000 saving over 3 years (32%)

- Finance BNPL: £400,000 saving over 2 years (30%)

- Utility : £50,000 saving over 1 year (33%)

- Oil : £6,000,000 saving over 3 years (50%)

Whether your bureau contract is up for renewal, or you want to renegotiate a better deal mid-term, you can successfully negotiate cost savings.

Get in touch today for a FREE data benchmarking assessment.

Email: n.frazer@purplepatchuk.com. Or call: 01789 551392.

Our Services

PurplePatch offers a range of services designed to support and ensure credit risk and procurement professionals get the best advice on products and prices currently available in both UK and international credit risk information marketplaces.

We work alongside your credit risk and procurement teams to understand your requirements and then leverage our experience to make recommendations on products, providers, and pricing specifically suited to your business needs.

Even if you have a preferred supplier, to lower credit bureau prices and to negotiate a fairer deal, we recommend data benchmarking for leverage.

Creating complete transparency and showing you what credit data is available on the market and the prices others are paying, we can support you in two ways –

Phase 1: FREE proof-of-concept data benchmarking exercise

Behind the scenes, we support by:

- Providing pricing benchmarks - for free (and under NDA)

- Identifying inflated charging

- Pinpointing low hanging fruit

- Providing a view on potential savings

- Identifying strategic decisions that could be considered

Phase 2: Additional fee-based consultancy

Once we've highlighted cost savings and you choose to instruct us, we provide:

- Evidenced based target pricing for each search and product

- The right to use the PurplePatch name in negotiations

- Strategies to reduce reliance and costs

- Additional data sources to be considered

- View on the licence, hosting and maintenance fees

- Under-usage identified and monetised

- Beneficial commercial terms to mirror

- Advice at each iteration of negotiations

- An approach that offers high potential savings more rapidly than going to RFP

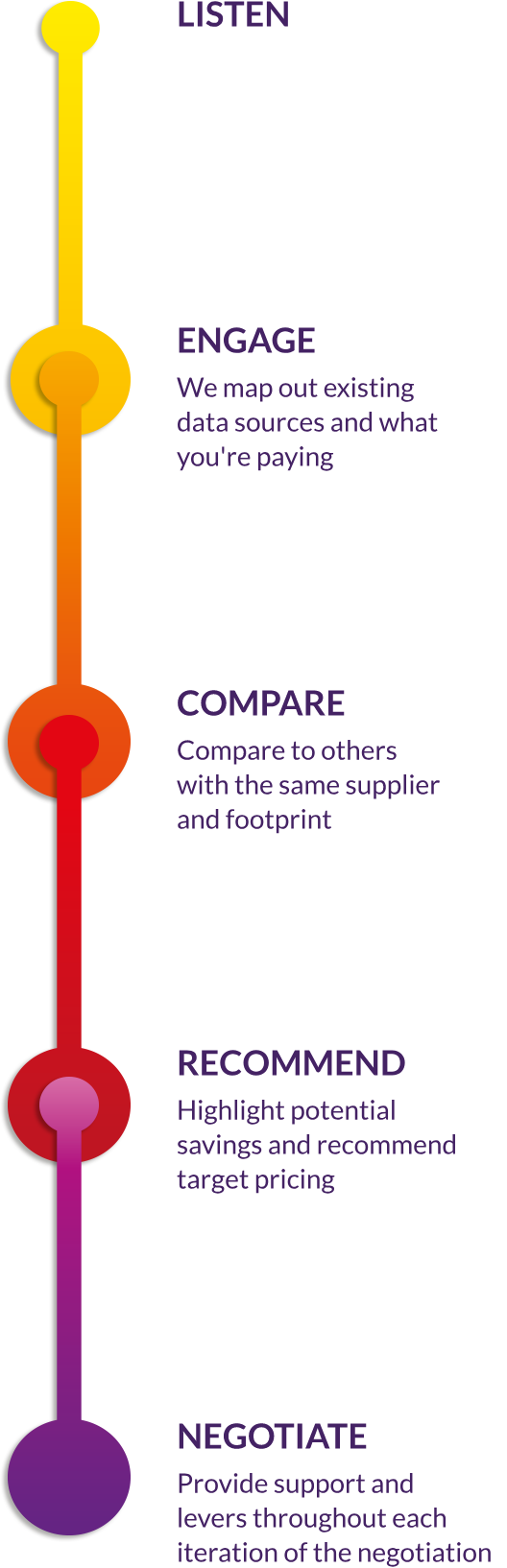

Our process

Our Expertise

With over 60 years of experience working in senior leadership positions at the top bureaux, not only have we gained a great understanding of the products and data available in the market, but also an internal and external view of sales practice and pricing in this highly competitive marketplace. We leverage this advantage when working with our customers to ensure they receive the best products, services, and prices.

Take a look at our flipbook to find out more about the Nicks and why they set up PurplePatch: Meet the team.

Nick Frazer

Co-founder at PurplePatch

Nick has over 30 years of experience in the credit risk information industry working from sales management to board positions of Dun & Bradstreet, Equifax, and Experian.

Nick Green

Co-founder at PurplePatch

Nick also has over 30 years experience in the credit risk information industry, with senior leadership positions as the Head of Sales at both Equifax and Experian.

Testimonials

Resources

Here are a handful of free resources, packed with tips and guidance to ensure you get the best priced and best quality data for credit risk programs.

Ultimate Guides

Blog

For the latest credit risk news and views, follow us on LinkedIn

FAQs

How do you get all the market information to prepare quality and price comparisons - in the UK and overseas?

Working with clients under NDA, we have conducted hundreds of data benchmarking exercises and therefore built an extensive database of price points. Feedback on data quality, coverage, and price from clients across all sectors is invaluable when advising others.

Why do you offer a free benchmarking assessment? And what's included in this?

This approach is really popular with our clients as there is little work required from them and the feedback they receive will either give the stamp of approval on pricing or highlight areas where savings can be made.

Are you an accredited third-party?

PurplePatch renews its Hellios FSQS stage 2 qualification annually. This accreditation is a benchmark used by major banks and financial institutions when selecting suppliers, helping to mitigate third-party risk and adhere to regulatory requirements.

Can PurplePatch help us get the best price/deal if we stay with our current credit risk data supplier? And if so, how are PurplePatch rewarded?

If you are intending on remaining with your current credit data provider, but want to check you are being charged a fair rate/want to negotiate a better rate, PurplePatch will research the market to ensure you are receiving a fair market price for the products and services supplied.

Based on our advice and recommendations, and only when you receive a reduced rate for your renewal, a fee will be levied of 20% on any savings you make against your previous contract.

If you do not receive a reduction in spend, PurplePatch services will be free of charge.

Contact Us

Purple Patch Broking Ltd

Penrho Hall

Hafod Y Ddol

Mostyn

Holywell

Flintshire

CH8 9EJ

01789 551392

n.frazer@purplepatchuk.com